On January 1st, 2019, as two Executive MBA graduates from AMS inspired to make a positive impact in society, we joined forces to look for solutions to today’s unsustainable economy. Using our business and consulting skills, we decided to focus on removing barriers to the adoption and scaling of circular economy practices. We worked on a test case involving residual waste streams from discarded refrigerators. In this blog, we will briefly share what we did and the lessons we learned.

We may look like consultants, we may function as executives, but in our heart of hearts, we are academics. And so, there was much debate on where to begin. Literature was reviewed, best practices were analyzed (and critiqued), as we ventured onward to a Minimum Viable Product.

We decided that it would make the most sense to first focus on the Circular Economy, where many companies still lack a methodology to make the transition towards a sustainable, zero-waste business model. Our starting point, therefore, was to develop a consulting framework that would help organizations transform in a structured way, with business model innovation for circular economy at its core (see the 5 steps below).

We were then presented with an opportunity to advise a well-known European waste management consortium – and in particular its business unit that specializes in the recycling of electronic waste, including refrigerators. The company has the explicit mission statement to spearhead the circular economy. Waste no more. But the business still struggles to find safe and cost-effective solutions for some of the residual waste streams from discarded refrigerators.

Profitable PU recycling plant

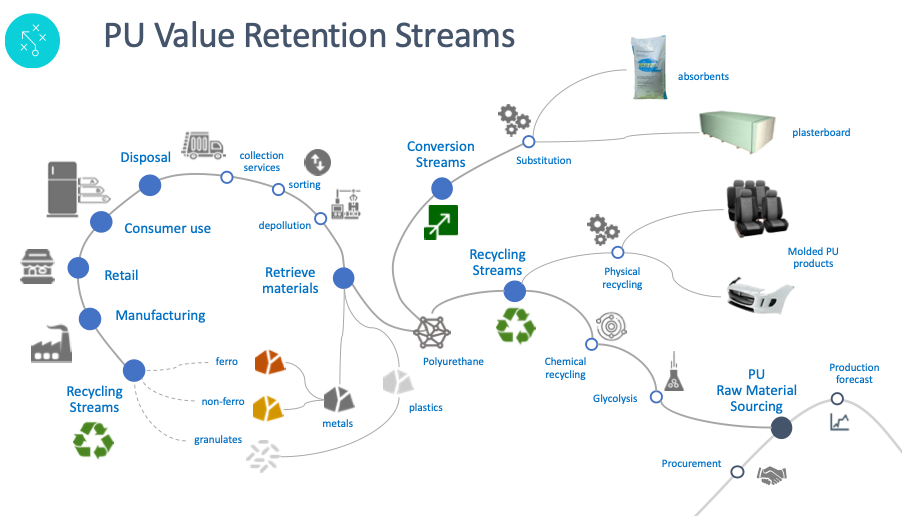

One such waste stream is polyurethane waste. Our research found that polyurethane (PU) waste is best processed through (split-phase) glycolysis, a chemical recycling process that allows to fully recover the polyol properties of PU waste. We discovered a doctoral thesis by Diego Simón Herrero that includes extensive advice on how to set up a profitable PU recycling plant. Our initial analysis showed that this could represent a significant economic opportunity, as well as an environmental solution.

To scale such a plant to the volume required by the test case client, several millions of investment funding would be needed. We were fully prepared to work out a more detailed business case and project plan for this solution, including alternative business models and venturing modes (joint ventures, partnerships), as well as operating and go-to-market strategies. However, we encountered a reluctance to investigate the business opportunity further.

Beyond core business

Why the resistance? The main reason, it seems, is that such an investment would take the company beyond their core business of recycling electronics materials and into the area of chemical recycling. In short, our proposed business model does not fit the company’s current strategy. We were disappointed, of course, but it got us thinking about bigger questions.

If the corporate strategy fails to address strategic (and societal) challenges, is it still the right strategy? Is it really strategic fit that causes resistance, or is it old business models and paradigms that oppose the transition to a circular economy? A major issue with traditional business models is that they exclude the cost of externalities, the cost of doing business that is imposed on society. Companies privatize benefits and socialize costs. No wonder they are so powerful and profitable.

Another case we investigated illustrates the point. A bright team of AMS students were also working on circular business model development for their master’s thesis. Their study case was a large specialty electronics manufacturer, interested in solutions for circularity applied to one of their product lines. The team presented a viable, circular model to the management team, but to their surprise, it was not taken up.

The problem in this instance is that the current products have healthy margins, since they do not include the externalities of producing them. In fact, to avoid these externalities, the organization went so far as to charge hefty transport costs, so that the legal obligation of accepting returned products at end-of-life was avoided. The net effect of this is that only a marginal number of end-of-life units are being returned to the company.

Take-make-waste paradigm

At this point, we came to a pivotal assessment: To internalize profits and externalize costs is not inherent to traditional business models, it is the traditional business model. It is the core of the take-make-waste paradigm, and it is how many businesses continue to be profitable today. We began wondering how the strategies of the incumbents could be overcome. Perhaps we should leave incumbent businesses for what they are – obsolete – and focus on start-ups and scale-ups that are built on a new paradigm? If traditional business models are a disease, disruptive venturing may be the cure. In a subsequent blog, we will share how that revolution may happen.

Follow our work on LinkedIn: Linkedin.com/in/timvbroekhoven - Linkedin.com/in/auckedouwesisema