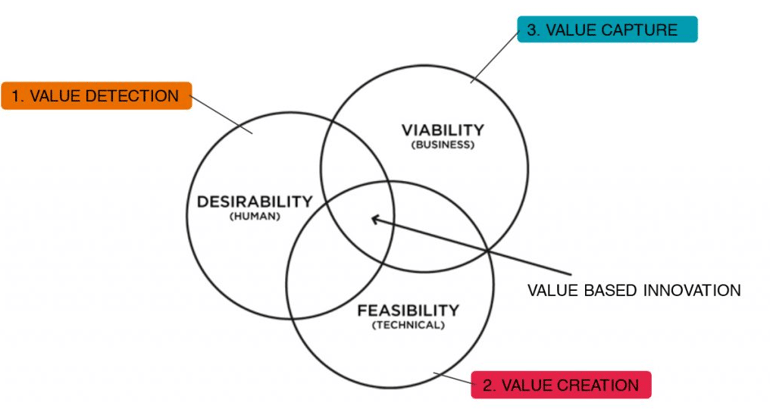

A few weeks back, I discussed the various methods of setting prices. We looked at cost-plus, competition and value-based pricing. The value-based method is seen as the best way to use your own strengths to outshine the competition. Prices based on value and the client’s willingness to pay have a solid foundation to build on. However, putting a value-based price on the product isn’t something that simply happens at the very end of the development process.

The three phases of value-based pricing

Everything starts with value detection. The first challenge is to discover the right value elements: What is it, precisely, that the customer is willing to pay for? What, to him, is the added value? And, right after that: How much is the client willing to pay?

If we have a sound insight in this, we can embark on developing the right product or service (value creation). If we do it well, the objective remains to capture all the value we provide; we must see a return of value to the company on the value we deliver.

In this piece and two further blog posts, I discuss the three phases of value-based pricing, starting with value detection. Some important questions about value detection are:

- How can we determine the most important value elements for our customers?

- How do we find out what is important to our customers?

Competence blindness

The biggest pitfall is thinking that you know your client well enough to decide on value elements for him. Often, you are so familiar with your product or service that you put your own ideas above the client’s real needs.

We call this “competence blindness.” Since your people (engineers, salespeople, etc.) are working with your products day in and day out, they focus on the elements they can improve or the elements that are important to them.

For example, the engineers for Porsche were crazy about the flat engine featured in their 911 model. To them, it was the perfect motor and the showpiece of the Porsche brand. However, the people at Porsche discovered that there was a very large group of potential clients ready to buy a Porsche, not because it had a flat engine, but because they valued the Porsche brand. Furthermore, they found out that these potential clients had the budget for a family car but not for a family car and a sports car.

Latent needs

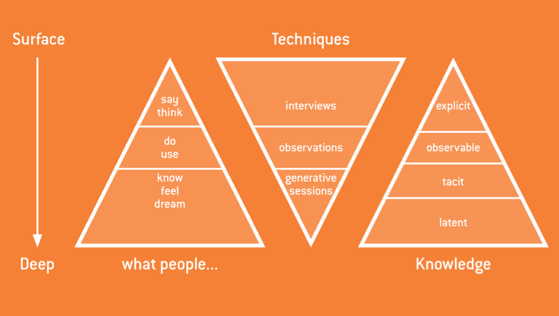

So, it is best if you determine the needs with the potential client himself. That, in itself, is a great first step. However, we notice that direct questioning often only detects explicit needs. Those are the things the client knows about and can put into words. Often, these are incremental changes, but it’s still a good start.

It becomes really interesting when we dig deeper, to find tacit and latent needs. These are the values the client isn’t able to describe precisely (tacit) and perhaps isn’t even aware of (latent). As a result, he won’t be able to name them in an interview or focus group.

To uncover these deeper-rooted needs or desires, we have to bundle various qualitative research methods. We have to interview and engage in observation and, for example, co-create a number of prototypes.

This way, we get a deeper insight into our clients’ personalities, and we can map out what they need and value.

Qualitative research

It is very important to have a structured approach to qualitative research. Embarking on research without proper preparation is like trying to find a needle in a haystack. In the dark. With no light.

Before we start, we have to construct as solid a hypothesis as possible, which we can then further validate and specify through research. This way, we can work with purpose and achieve results faster, which we can then use for further research.

The next blog post will take a deeper look at the next step. How do we translate what we’ve learned from the value study into specifications for the development of new products or services? Read all about it next month!

One step back?

Read the introductory blog post in this series,

'Price has the biggest influence on turnover'