Lately, I have been getting a lot of questions from colleagues, friends, and family about the impact of COVID-19 on the financial markets. I hope to address these questions in this article.

Help, I have never invested in stocks before, what are the best stocks to buy?

In 2019, any financial expert would have thought it to be sensible if you were to invest in blue chip companies such as Shell (RDS.A), AB Inbev (ABI) or KBC Bank (KBC). Today, these companies’ stock prices are trading at -30 to -50 percent compared to the highs in 2019. My best advice here is to stay away from individual stocks.

We are now (slowly) learning how COVID-19 is impacting our economic system, and the lowest-risk bet that you can make is that the economic system as a whole will recover from this crisis. My favorite alternative to individual stocks are passive ETF's (Exchange Traded Funds). One passive ETF can contain 100+ shares. For example: Vanguard S&P500 (contains the top 500 listed US-based companies such as Apple, Microsoft, Esso, Facebook, etc.).

Historically, passive ETF's have outperformed actively managed funds. So, putting your money in these ETF's will cost you less (because the management fee is 10 to 50 times lower) and you are more likely to fare better in the long run (as numerous studies have pointed out).

Ok... So, at what price should I buy?

You just touched on one of the most complex things in investing. In the industry it is called "timing the market". The idea is that you buy a share at its lowest price, and then you sell it at the highest possible price. Some say it is impossible to know beforehand how prices will evolve. In the financial news opinion section there will be many people selling the idea that they have a magic wand and can predict when a stock has reached bottom price, but to be frank, you cannot time the market. I cannot time the market. Nobody can consistently time the market. So, we need a different strategy.

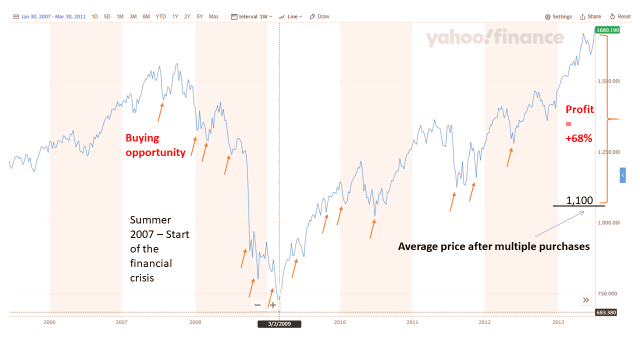

The recommended strategy here is dollar-cost averaging (or euro-cost averaging for my predominantly European audience 😊). Instead of using up all your funds at once, you use only a small percentage. Thus, you will have multiple opportunities to buy at the lowest price and try to sell at a higher price in the future.

A simple example:

Buying up a small chunk of an ETF on a quarterly basis during the 2008 financial crisis would have netted you a 70 percent return-on-investment between 2007 and 2013.

Thanks, any last advice?

Yes, once you have made your first small purchase, I would like you to:

- Relax. Investing is a long game. If you invest in well-diversified, low-cost ETF's (only), your patience will pay off. (Also... only invest money that you do not need in the short term).

- Do not check the price ticker every single minute. You already put your money to work. Again, you need to relax. In these volatile times, I advise to check in on a weekly basis and decide whether you want to add a small purchase if the price has declined or stagnated.

- Do not follow the financial news section all of the time. Plan ahead when you will allocate some time to briefly check it out. As a matter of fact, if there is 1 article I advise you to read, it is probably this one (it is a great sarcastic article).

- Take care and stay safe!

About the author

Yassin Boullauazan is researcher at Antwerp Management School. He has been trading stocks privately for over 10 years. Yassin graduated with a master degree in Applied Economics at the University of Antwerp and feels very passionate about increasing financial literacy of the general public and is thus always open for a chat on personal finance and financial markets. Contact him with your questions via Yassin.Boullauazan@ams.ac.be.