What are the different ways to generate income as an organization?

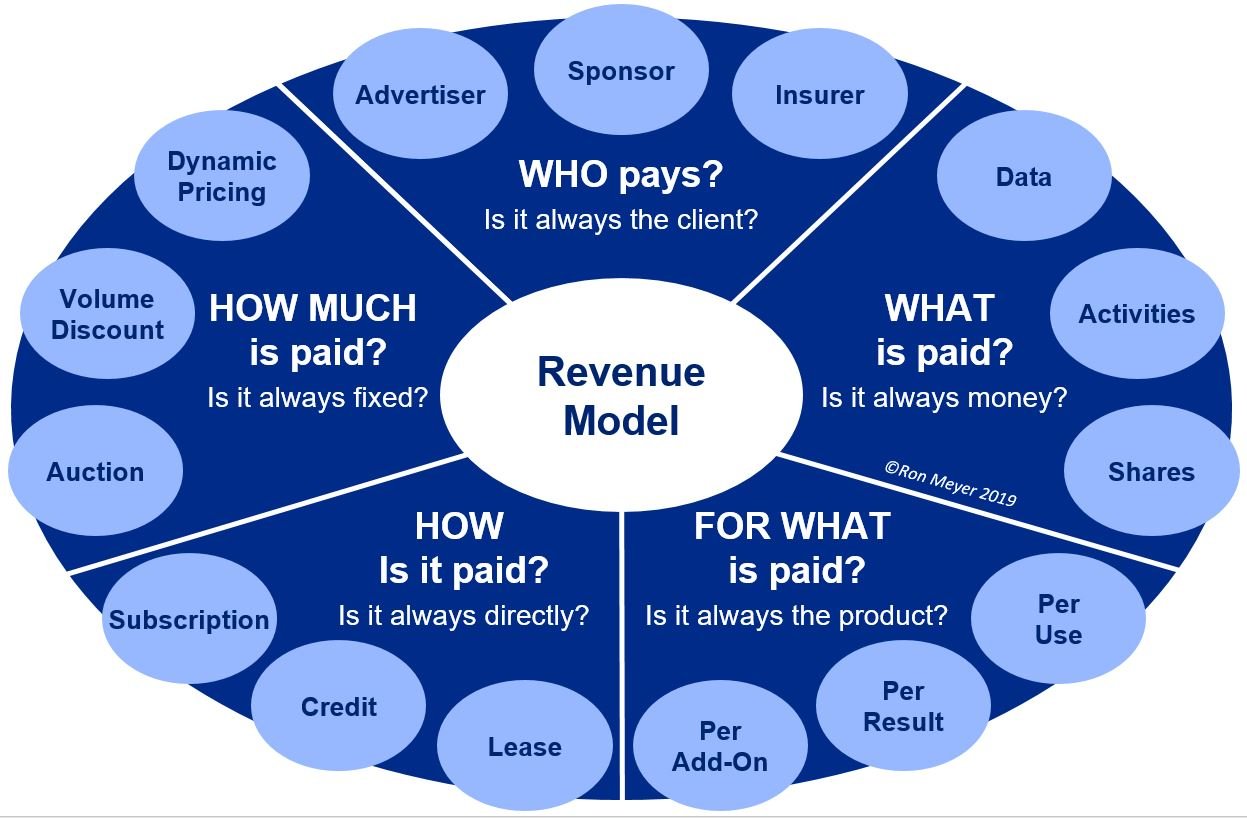

All organizations need money to operate and thus require ways to generate sufficient income. An organization’s revenue model is the specific manner by which it acquires funds – it constitutes the way in which the organization gets paid.

In a typical company, the implicit standard approach is that revenue comes from selling products or services to customers who directly pay the list price in cash. There are, however, many different ways of generating income apart from this ‘default revenue model’.

Conceptual model

The revenue model framework outlines the five categories of choices that make up a revenue model. Each category is formulated as a question concerning payment and contains three common examples of alternatives to the default option. These sets of examples are not exhaustive; each of the five categories holds more possibilities. The categories themselves, however, are exhaustive and all need to be addressed.

5 key elements to change

The five revenue model categories that need to be addressed are:

- WHO pays? From whom does the money come? Even if we say ‘the client’ it may not be the actual user who transfers the funds but e.g. the user’s mother, the budget holder or the procurement department. And looking beyond actual users, money can also come from:

- Advertisers, paying for the opportunity to promote something else.

- Sponsors, paying to support something/someone unable to generate sufficient income.

- Insurers, paying out some risk covered by insurance.

- WHAT is paid? Can clients pay with something other than money? Bartering has been around for a very long time, so we are used to exchanging goods for something other than coins. Common alternatives to monetary income include:

- Paying by giving (personal) data to the supplier.

- Paying by performing (small) services for the supplier.

- Paying by giving a part of future revenue streams to the supplier.

- FOR WHAT is paid? What does the client get in return for payment? Besides paying and receiving a product or service (pay per product), clients can also pay based on receiving other benefits such as paying:

- Per use. Paying only for the actual time or intensity of use.

- Per result. Paying only for the results that are achieved.

- Per add-on. Paying only for the extras on top of the base product.

- HOW is it paid? By what means does the payment take place? In the default situation, payment is a straight-forward exchange with ownership being acquired by paying the entire amount directly in full. But payment can also be made by:

- Lease. Paying for exclusive use of a product for a certain period of time.

- Credit. Paying for a product/service in instalments over a certain period of time.

- Subscription. Paying for access to a shared product/service for a certain period of time.

- HOW MUCH is paid? What method is used to determine the price? Of course, everyone knows that list prices are often just the first bid in a negotiation process. But apart from fixed pricing and negotiations, prices can also be set by:

- Auction. Paying the price set in a multi-party bidding process.

- Volume discount. Paying a price calculated by the volume of products purchased.

- Dynamic pricing. Paying a price calculated by time, place, demand and availability.

5 key insights to change

- Strong default revenue model. When looking at streams of income, companies often automatically start from the ‘normal’ situation of asking prospective users to directly pay the listed price for a product or service. This model has become so dominant that it may easily stand in the way of considering alternatives.

- Revenue models have five dimensions. Every revenue model must address the questions ‘who pays?’, ‘what is paid?’, ‘for what is paid?’, ‘how is it paid?’ and ‘how much is paid?’. It ‘pays’ to consider each question explicitly instead of just following the default model.

- Every revenue model dimension has many options. There are many different possibilities within each revenue model dimension. We presented only some of the more popular ones by way of illustration.

- Striving for multiple revenue streams. When designing a revenue model, companies shouldn’t limit themselves to one option per dimension. It makes sense to consider offering payers multiple options (e.g. pay per product or pay per use), as well as developing multiple revenue streams by putting together a (sub-)revenue model per payer category.

- Integral part of the business model. Designing a revenue model is not a stand-alone activity but an integral part of creating the organization’s business model. It is a strategic activity, not one that should be left to operational decision-makers.

This blog is part of a series, if you want to see all the blogs, then click below